The 6-Second Trick For Medicare Advantage Agent

The 6-Second Trick For Medicare Advantage Agent

Blog Article

Indicators on Medicare Advantage Agent You Should Know

Table of ContentsThe Best Guide To Medicare Advantage AgentThe Greatest Guide To Medicare Advantage AgentHow Medicare Advantage Agent can Save You Time, Stress, and Money.The Best Guide To Medicare Advantage AgentNot known Details About Medicare Advantage Agent Medicare Advantage Agent - Truths

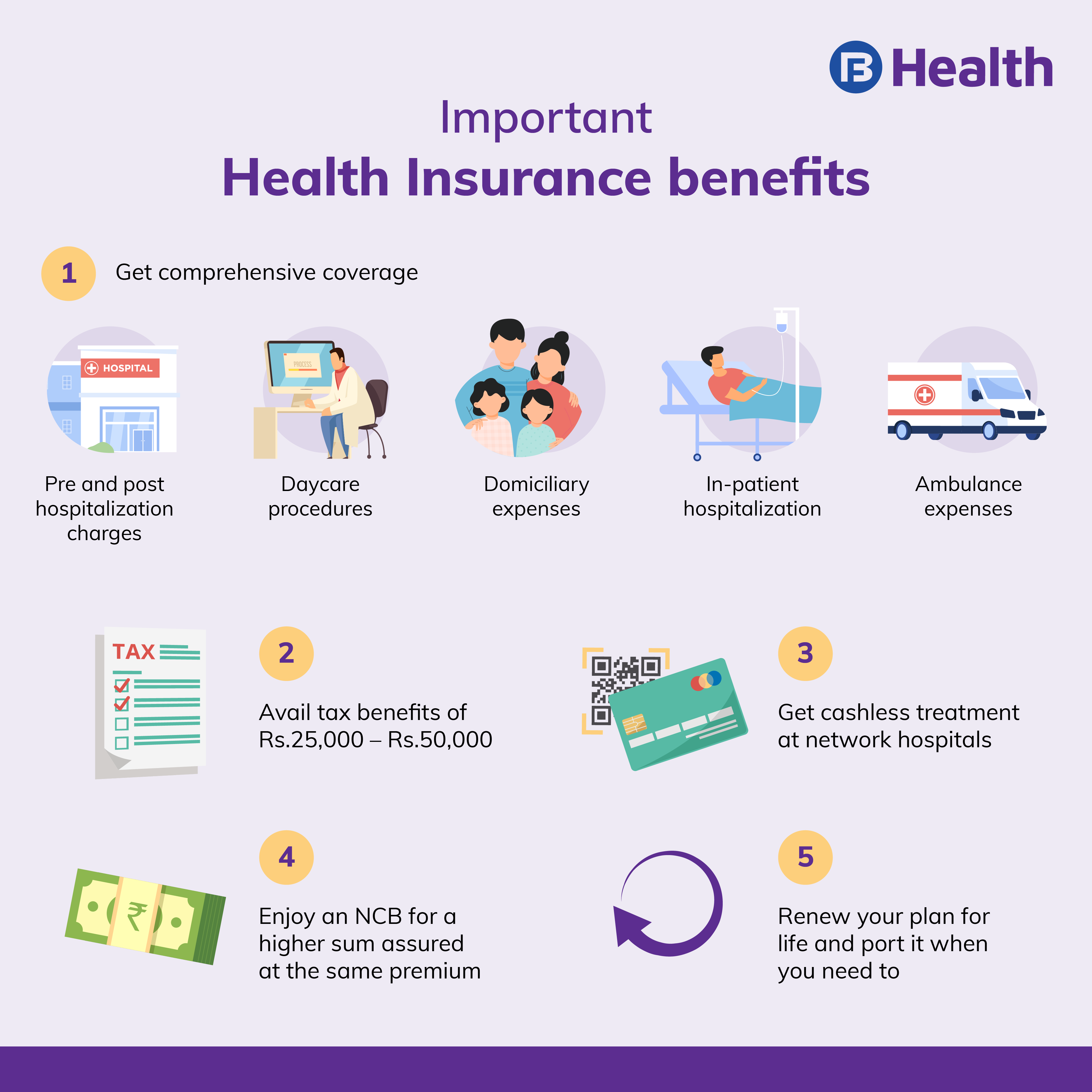

If the anesthesiologist is out of your health and wellness strategy's network, you will certainly obtain a shock costs. State and federal regulations secure you from surprise medical bills.You can utilize this period to join the strategy if you didn't previously. You can likewise utilize it to drop or change your coverage. Plans with higher deductibles, copayments, and coinsurance have reduced premiums. But you'll need to pay even more out of pocket when you get care. To learn a company's monetary rating and complaints background, call our Help Line or see our website.

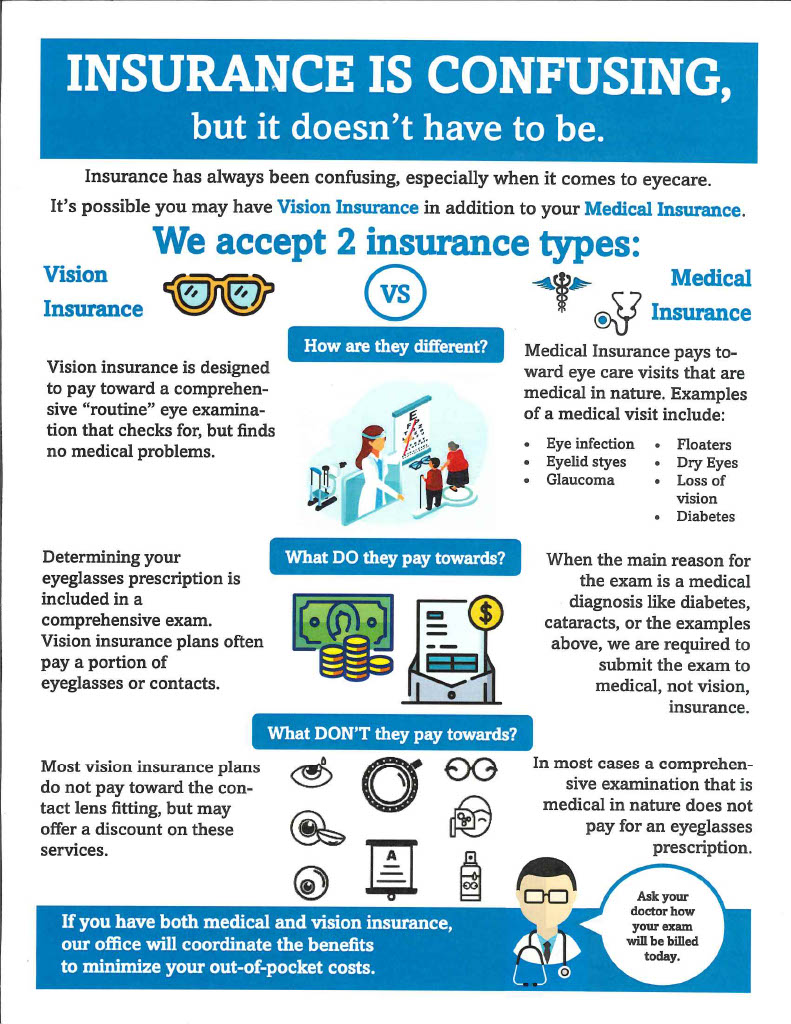

Know what each plan covers. If you have physicians you want to keep, make certain they're in the plan's network. Medicare Advantage Agent.

10 Easy Facts About Medicare Advantage Agent Shown

Make sure your medicines are on the plan's checklist of authorized medicines. A strategy won't pay for drugs that aren't on its checklist.

The Texas Life and Health Insurance policy Guaranty Organization pays cases for health insurance policy. It does not pay claims for HMOs and some various other kinds of strategies.

Your spouse and children additionally can proceed their coverage if you take place Medicare, you and your partner divorce, or you pass away. They should have gotten on your plan for one year or be younger than 1 year old. Their protection will end if they get various other protection, don't pay the premiums, or your employer quits providing health insurance.

The smart Trick of Medicare Advantage Agent That Nobody is Talking About

If you continue your insurance coverage under COBRA, you need to pay the premiums yourself. Your COBRA coverage will be the same as the insurance coverage you had with your employer's plan. Medicare Advantage Agent.

When you have signed up in a health insurance, make sure you recognize your plan and the price implications of various procedures and solutions. For instance, going to an out-of-network physician versus in-network commonly costs a customer far more for the same sort of service. When you register you will certainly be provided a certification or evidence of insurance coverage

Medicare Advantage Agent for Beginners

It will certainly also tell you if go to this web-site any type of solutions have restrictions (such as optimum amount that the health insurance plan will certainly pay for durable medical tools or physical therapy). And it must tell what services are not covered in any way (such as acupuncture). Do your homework, study all the options offered, and review your useful link insurance policy before making any type of decisions.

Indicators on Medicare Advantage Agent You Need To Know

When you have a clinical procedure or check out, you usually pay your healthcare service provider (doctor, medical facility, therapist, etc) a co-pay, co-insurance, and/or a deductible to cover your portion of the provider's costs. You expect your health insurance to pay the remainder of the bill if you are seeing an in-network provider.

Nonetheless, there are some cases when you may need to sue yourself. This might occur when you most likely to an out-of-network provider, when the copyright does not accept your insurance, or when you are traveling. If you need to submit your very own health and wellness insurance case, find out here call the number on your insurance policy card, and the customer assistance rep can educate you how to sue.

Lots of health insurance have a time frame for the length of time you need to submit a case, generally within 90 days of the service. After you file the insurance claim, the health insurance has a minimal time (it differs per state) to educate you or your service provider if the health and wellness strategy has accepted or refuted the claim.

Indicators on Medicare Advantage Agent You Should Know

If it chooses that a service is not medically needed, the strategy might deny or decrease payments. For some health plans, this clinical requirement decision is made prior to treatment. For other health insurance, the decision is made when the company obtains an expense from the copyright. The firm will send you an explanation of benefits that lays out the service, the amount paid, and any type of additional quantity for which you may still be accountable.

Report this page